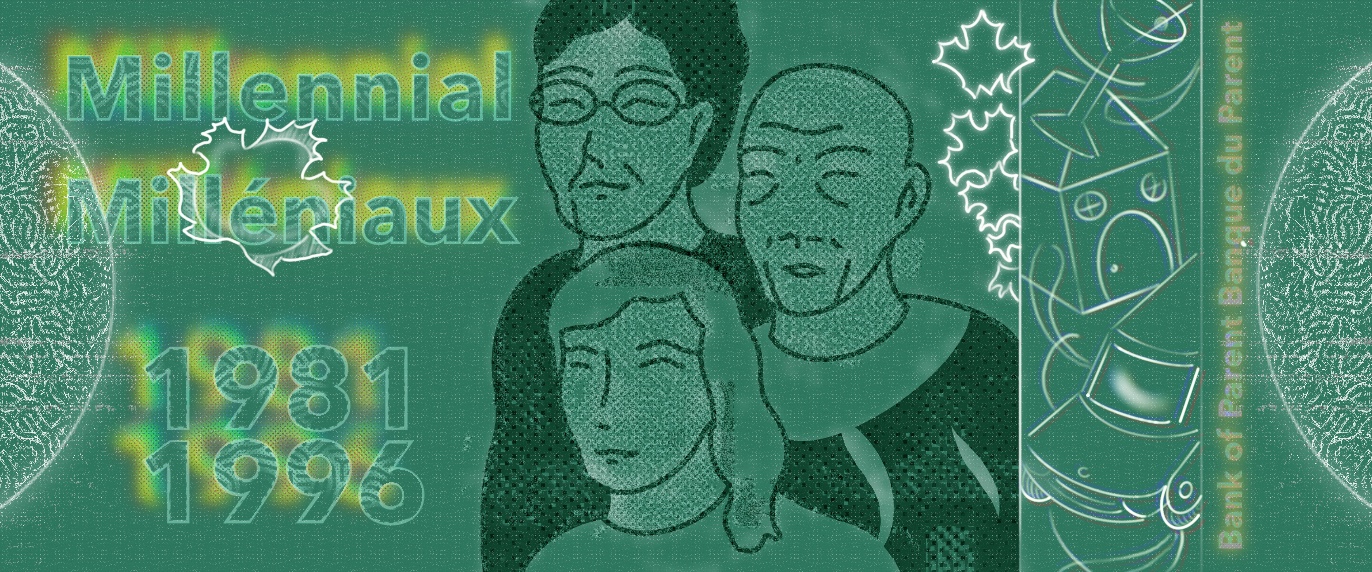

Finding examples of the Bank of Mom and Dad’s local presence might not be as simple as a quick search for “ATM near me,” but you probably know it when you see it. That friend who didn’t have to work in the summer before law school. That couple who works in legal aid for a non-profit yet somehow just closed on a three-bedroom house…

Statistically speaking, it’s probably you, too. According to a recent BMO survey, 81% of parents today provide financial assistance to their adult children, compared to just 40% of parents who reported receiving the same financial support 20-30 years ago from their own parents.1

The Bank of Mom and Dad has many branches, offering a variety of services from cell phone bills, flights home for holidays, rent, and even mortgage payments. “Between now and 2026,” writes Katrina Onstad for Maclean’s, “an estimated $1 trillion will move from Canadian baby boomers to their heirs, mostly millennials.”2

Enter, once again, the familiar stereotype of spoiled and entitled adult kids spending money they don’t have on brunch or lattes. It’s a powerful image to direct our frustration towards, because there’s a lot to be frustrated about.

Most of us were raised on the idea that things like a fulfilling career, starting a family, and owning a home, were seen as viable milestones for Canadians who were willing to work for them. And though few would argue that we live in a completely egalitarian society, most of us have been more-or-less committed to at least pretending we live in this kind of meritocracy. However, the so-called “great wealth transfer” of mass inheritances for some will make Canada into a place where, in Onstad’s words, “a person’s success in this country is determined not by hard work or education, but by how rich their parents were.”

Mortgage-in-law

Housing: no sector has been more clearly influenced by the Bank of Mom and Dad. A recent CIBC survey showed that 31% of first-time home buyers in Canada received financial help from their parents or a relative, with the average gift being $115,000.3 The market repercussions are considerable, driving up already-inflated prices and limiting the pool of potential buyers, which helps explain why 35% of adult children live with their parents, in part because of these rising costs.4

Pretty simple, right? Want to own a home, all you need is to be born into a wealthy and generous family.

Unfortunately, that doesn’t tell the whole story. Experts warn that even when parents have the means and desire to offer their children this kind of support, things can get messy fast. What's $100,000 between kin? Well, it turns out, a lot of money.

It’s crucial to establish clear expectations in terms of whether the money is a gift or loan, and any repayment plans that may apply. There are also the somewhat awkward but always necessary what-ifs to consider. If you sell the house at a gain, who gets the profits? If you and your partner split up, do you have to give the house back to her parents, who gifted you the downpayment?

Parents also need to consider if they truly have the means to offer this kind of support. A recent survey by TD Bank reveals that while 57% of Canadian parents expect to financially support their adult children, most doubt their ability to make it work.5 “In some cases,” describes Susan Doran for Real Estate Magazine, “parents are flying without a net, pulling funds out of their retirement savings or equity from their own home, using a second mortgage or home equity line of credit to assist, potentially putting their retirement at risk.”6

Minding the family business

Issues of familial privilege are especially relevant to the legal community. First because of how much money it costs to even enter the profession. Those who take on hefty student loans are more likely to graduate under pressure to practice in more lucrative fields, taking jobs at big firms in urban centers. Their counterparts with family money, however, have the privilege to follow a passion into less lucrative fields of practice, or practice in smaller communities. It’s a dynamic that ultimately jeopardizes access to justice across Canada.

Related: Student debt: Seeking out the truth, the whole truth, and nothing but the truth

But when we talk about generational privilege in any professional context, it's crucial to understand that it isn’t all about money. It’s also a matter of mentorship.

Recent data indicates that “children of lawyers are 17 times more likely to become lawyers than children whose parents did a different job.”7 Unsurprisingly, second-generation lawyers have higher employment rates, are more likely to work in private practice, and more likely to get a prestigious judicial clerkship, than their law school classmates who are first-generation college students.8

Wait, you might be thinking, is this really that big of a deal? After all, so many businesses function like this, from Hollywood to financial services. If you have any doubts about how long family businesses have been around, just think about where the last names like Smith, Taylor, and Carpenter came from. No, the idea that our parents’ occupations define us is nothing new. And it’s also not inherently nefarious. Second-generation professionals can be an asset to any industry, as children build on the legacies of their parents and learn from their mistakes. Kids who grew up with a front row seat to any profession gain access to the type of knowledge that’s hard to convey in a textbook. Even if a parent isn’t consciously influencing their child, kids pick up on things like managing work/life balance, inner-office conflicts, and client communication. These lessons are invaluable, and it’s worth thinking about how they might be shared more widely across the profession to benefit everyone—not just those who were born with a head start.

Reading between the resumes

In her essay, “Diversity: More than Ticking Boxes,” Andreina Varela-Taylor recounts the “myriad challenges and barriers” she experienced as an immigrant navigating Canada’s legal profession.9 “Despite the heightened attention focused on underrepresentation and a growing call for diversity,” she writes, “the profession continues to have small numbers of law students, associates, counsel, and partners with diverse backgrounds.”

While today’s firms may say they value diversity, they're less excited about what a so-called “diverse” background might look like on a candidate’s resume. For example, students who don’t have the means to cover tuition costs or confidently take on debt might work part-time through school, resulting in lower grades than classmates who were able to devote themselves full-time to study. Similarly, a new applicant might boast a prestigious internship on their CV, but they’re less likely to mention the family friend who helped secure them the spot. This isn’t to say that all privilege negates ability, but it demonstrates how resumes prop up certain kinds of experiences more than others.

Similarly, no one’s faulting parents for wanting to do everything they can to help their child succeed. The problem is that these advantages skew an already unbalanced system further in favour of those who come from wealth.

Varela-Taylor advocates for firms to judge candidates more holistically, taking a wide-angle view of all the assets lawyers from different backgrounds bring to the office. Consider, for example, the linguistic and intellectual prowess it takes to navigate law school in your second (or third) language, or the determination of a student studying for the bar on break during a shift as a barista or delivery driver.

Let’s talk about cash, baby

If you’re somebody who receives any level of support from your parents, it’s helpful to be open and honest about it with your peer group. Yes, it might be awkward and induce some side-eyes, but it helps set realistic expectations for those who aren’t getting the same help.

As we have these conversations, it’s also important not to lose sight of the bigger picture. Because make all the brunch jokes you want, but if 81% of young people can’t get by without financial assistance from their parents, what does that tell you about our economy? After all, some of us might be old enough to remember a time when earning a living wage and owning a home were relative givens (not luxuries) for working Canadians, especially those who’d invested in professional degrees.

This is where broader change comes in, the kind that’s complex and takes time. This includes things like advocating for tuition reform and calling for greater diversity in the profession.

It’s also worth remembering that money and a proverbial rolodex aren’t the only things we inherit from our parents. They give us a lot. Though conversations about financial privilege are important, we can’t lose sight of the non-monetary things we inherit, too: grit, resourcefulness, a biting sense of humour. These are qualities whose actual value can’t be reduced to dollars. So, why not give mom and dad a call sometime, just to say hi?

And while you’re at it, why not call us, too?

We’re proud to offer pro bono financial planning services to every member of Canada’s legal community. Connect with an expert and create a customized plan to manage debt, invest in your future, and build a budget that leaves room for living.

Book a pro bono financial planning meeting now

Sources:

1. BMO Wealth Institute, “The Bank of Mom and Dad – a source of comfort for everyone,” December 2015

2. Maclean’s, “The Jackpot Generation,” September 2024

3. MoneySense, “6 things to consider before borrowing from the Bank of Mom and Dad for your first home,” July 2024

4. CBC News, “’Why pay double for everything?’ Meet the adults who live with their parents,” October 2023

5. TD Stories, “Nearly 3 in 5 Canadian parents expect to financially support their children after they become adults, but most aren’t confident in their ability to do so,” October 2024

6. Real Estate Magazine, “The bank of mom and dad: Talking extremes to secure children’s homeownership dreams in steep markets,” March 2024

7. Legal Cheek, “Children of lawyers 17 TIMES more likely to become lawyers themselves,” March 2019

8. Above the Law, “First-Generation Lawyers Faring So Much Worse in Employment Outcomes Should Be an Outrage,” October 2021

9. CBA National Magazine, “Diversity: More than ticking boxes,” October 2020